A Cash Box Structure

Kate Anderson | 05/10/20

What is it?

A cash box structure or placing is a method used by a plc to raise funds quickly from institutional investors. It is a cheaper method of raising funds than a more traditional placing of shares, rights issue or plain vanilla debt financing.

Why use one?

The principal benefits of using a Jersey cash box structure are as follows:

• the statutory pre-emption provisions contained in the UK Companies Act 2006 (the Companies Act) do not apply where a Jersey cash box structure is used as the shares issued by a UK plc (UK plc) are issued for a non-cash consideration. This avoids the time and expense of seeking shareholder approval to disapply the statutory pre-emption rights or otherwise conducting a pre-emptive rights issue;

• the use of a Jersey cash box structure may allow UK plc to create distributable reserves (rather than share premium) following the issuance of new ordinary shares by taking advantage of the merger relief provisions under the Companies Act; and

• investment banks and brokers find these structures very appealing as they keep underwriting risk and documentation to a minimum but at the same time maintain good commission levels.

How does it work?

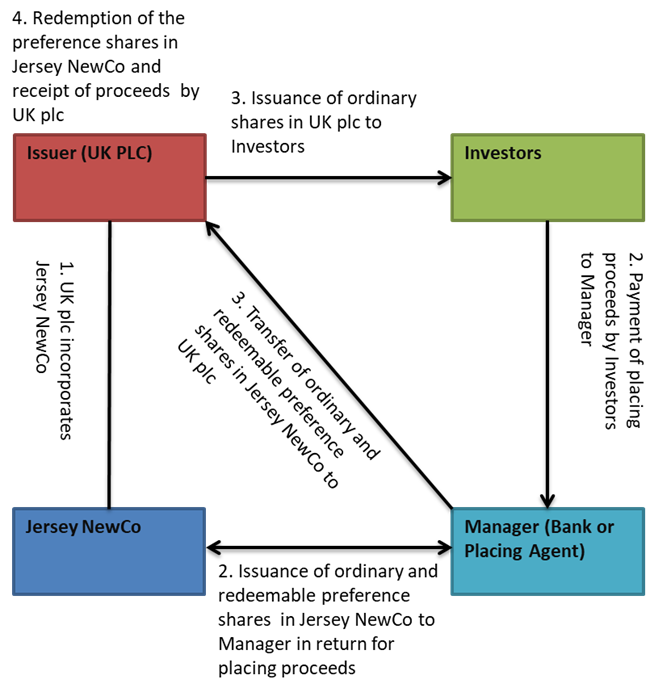

• UK plc incorporates a Jersey private company as the “cash box” (Jersey NewCo). Jersey NewCo will usually be managed, controlled and tax resident in the UK therefore ensuring that HM Treasury consent is not required with regard to the issue or transfer of Jersey NewCo shares;

• Jersey NewCo issues redeemable preference shares to a manager (such as an underwriter or placing bank) (the Manager) pursuant to a share subscription and transfer agreement. The redeemable preference shares are fully paid up, with the Manager using placing proceeds received from investors identified by the Manager (the Investors) (at this point, Jersey NewCo becomes the “cash box”). If merger relief under the Companies Act is to be availed of (i.e. relief from the creation of a share premium account on the issue of shares) the majority of the ordinary shares of Jersey NewCo will be held by UK plc and the remaining amount will be held by the Manager;

• the Manager pursuant to the share subscription and transfer agreement transfers all its shares held in Jersey NewCo to UK plc in exchange for UK plc issuing shares to the Investors. Therefore UK plc has issued shares for a non-cash consideration (i.e. in exchange for receiving the shares in Jersey NewCo) and, as such, avoids the statutory pre-emption provisions of the Companies Act. UK plc now holds all the issued share capital in Jersey NewCo and Jersey NewCo holds all the placing proceeds; and

• UK plc has several options now to recuperate the placing proceeds. Jersey NewCo can redeem the shares held by UK plc (typically for an amount equal to the placing proceeds), lend the placing proceeds to UK plc or distribute the placing proceeds to UK plc upon Jersey NewCo’s solvent winding-up.

A variation to the standard cash box structure described above is where Jersey NewCo issues bonds to Investors which are convertible into redeemable preference shares in Jersey NewCo. Upon conversion, the shares are transferred to UK plc in exchange for which UK plc issues shares to the Investors.

In this instance, Jersey NewCo may need to be incorporated as a “public company” from a Jersey law perspective and obtain additional regulatory approval. This would normally still remain a relatively streamlined process.

Bonds are often listed to qualify for the Quoted Eurobond Exemption from UK withholding tax on interest payments. The International Stock Exchange (TISE) is designated by HMRC as a recognised exchange and is used frequently for the listing of debt securities which includes convertible bonds. Voisin law provides high-quality cost-effective professional legal services for the listing of debt securities such as Eurobonds on TISE. Please see our client briefing here.

Why Jersey?

Jersey has become the leading jurisdiction for cash box structures for numerous reasons which include the following:

• Jersey companies can be incorporated within a few hours and Jersey NewCo can be tailored to suit UK plc’s specific needs;

• Jersey NewCo will be resident in the UK for tax purposes (and non-resident in Jersey for tax purposes). As such, Jersey’s economic substance rules will not apply. No Jersey resident directors are therefore required and board meetings do not need to take place in Jersey;

• Jersey NewCo will not be liable for any income, capital gains or withholding tax in Jersey. No Jersey stamp duty will be payable on the issue, transfer or redemption of Jersey NewCo’s shares;

• Jersey companies law is similar in many respects to English companies law while offering greater flexibility on redeeming shares, making distributions and the contents of a company’s memorandum and articles of association;

• Jersey companies can redeem shares from any source, including share capital, on the passing of a 12-month look-forward solvency statement;

• once it has fulfilled its purpose, Jersey NewCo can be wound up quickly, easily and with minimum cost. No liquidator is required to wind up a solvent Jersey company;

• Jersey is located in the same time zone as the UK and many investors are familiar with Jersey as a leading well-regulated international finance centre; and

• Jersey offers a range of highly experienced corporate service providers which deliver sterling administration, accounting and corporate governance services together with the necessary support for directors based outside of Jersey to participate in the control and management of Jersey NewCo.

Why Voisin?

Voisin’s corporate and commercial team is highly experienced and has previously advised on transactions which have utilised Jersey cash box structures.

Our focused, proactive and efficient approach has attracted a portfolio of clients which includes some of the world’s leading financial institutions. Our close relationship with local regulatory authorities, listing authorities, service providers and advisers worldwide enables us to work seamlessly as part of any team and allows us to provide a high quality and cost-effective professional service in all areas.

For further information or specific advice, please contact Kate Anderson.

This note is intended to provide a brief rather than a comprehensive guide to the subject under consideration. It does not purport to give legal or financial advice that may be acted or relied upon. Specific professional advice should always be taken in respect of any individual matter.